how do i get my employer to withhold more tax

Use the same tax forms you used the previous year but substitute this years tax rates and income brackets. Medicare tax is 145 of an employees wages.

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

On line H total all of the previous allowances you claimed for lines A G.

. When you make payments to employees certain contractors and other businesses you need to withhold an amount from the payment and send it to the Australian Taxation Office ATO. Remember to withhold 235 from an employees wages after they reach the threshold for additional tax. Calculate your income and deductions based on the income you expect for this year.

Use the current tax rates to determine your projected tax. The information provided on this form is used to determine the amount of tax to withhold from payments based on the PAYG withholding tax tables we publish. Whatever number is reported on line H is the number of allowances you can claim.

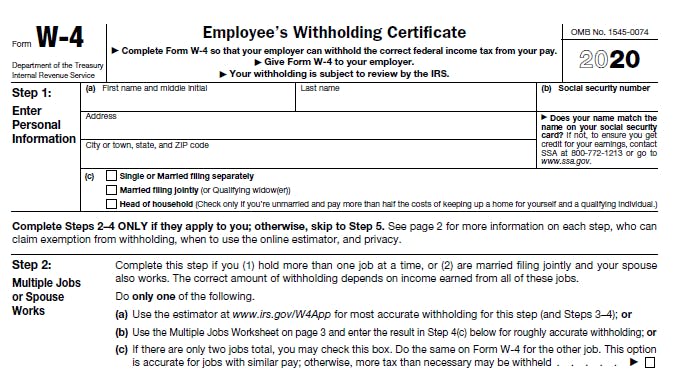

Fill Out a New Form W-4. If too much tax is being taken from your paycheck decrease the withholding on your W-4. Register for employer withholding tax online through the Online PA-100.

The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. The procedure depends on whether the excess withholdings were caused by multiple employers exceeding the maximum or too much being withheld by a single employer. Change Your Withholding To change your tax withholding use the results from the Withholding Estimator to determine if you should.

A Withholding declaration applies to payments made after the declaration is provided to you. Using the information you provided when filling out the form your employer will determine how much tax to withhold from your paycheck. Heres what to have.

After filing your tax return a smart financial move is to double check your Form W-4. Sign IRS Form W-4 at hire. These take into account the Medicare levy study and training support loans and tax-free threshold.

Calculate the minimum estimated tax payment to make If you determine that you need to make estimated tax payments then you should obtain Form 1040-ES to calculate the amount of each payment. You should advise part-time employees that it could be beneficial. Instead of a wage base there is an additional Medicare tax of 09 after an employee earns 200000 single 250000 married filing jointly or 125000 married filing separately.

Dont forget you must also withhold FICA tax on that check. Be sure to ask your employer the number of allowances you are currently making. Multiple employers Single employer.

Calculating amount to withhold. To adjust your withholding you will need to complete a Form W-4 and give it to your employer. SOLVED by TurboTax 3336 Updated December 20 2021 Yes you can get excess Social Security tax refunded.

However if you want to have the maximum withheld from your paycheck simply enter a 0 for lines A G and line H. Employees can choose to have more tax deducted from the remuneration they receive in a year. Your income information including information about other jobs.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Get a W-4 Form From Each Employee The IRS requires that all workers in the US. Your payee must get our approval to reduce the amount you would normally withhold by completing a PAYG Withholding variation application.

Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES by phone using TeleFile or through third-party software. If too little is being taken increase the withheld amount. This form includes important information you will need to pay the employee and to make sure withholding and deductions are correctly calculated on the employees pay.

PAYE is HM Revenue and Customs HMRC system to collect Income Tax. To adjust your withholding is a pretty simple process. Alternatively you can use the range of tax tables we produce.

Complete a new Form W-4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer. Its also probably a good idea to visit the IRS withholding calculator. Then compare that number to the number of allowances you get when you complete the new Form W-4.

Determine the withholding amount on the combined amount Lets say its 150 based on the withholding tables in IRS Publication 15-T Subtract the amount withheld from the regular wages for that payday 70 And withhold 80 150 - 70 from the bonus paycheck. One way to adjust your withholding is to prepare a projected tax return for the year. Your spouses income information if.

If your payee gives you another declaration it overrides any previous one. If you use tax preparation software such as TurboTax it will generate the form based on the information you provide. As an employer you normally have to operate PAYE as part of your payroll.

Give it to your employers human resources or payroll department and theyll make the necessary adjustments. Once youve used the Tax Withholding Estimator tool you can use the results of the calculator to fill out a new Form W-4. You need to submit a new W-4 to your employer giving the new amounts to be withheld.

Ensuring you have the right amount of tax withheld from your paycheck can make a big difference in your tax outcome next year. This is called PAYG withholding and works to prevent workers from having a large amount of tax to pay at the end of the financial year. This usually happens only in special circumstances where your employee can show that the withholding rate will result in them having more tax withheld than is required to cover the total tax they will need to pay in the year.

Select your situation for more info. This amount stays the same until they give their employer a new Form TD1. To do this they have to give a federal Form TD1 to their employer that shows how much more tax they want deducted.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

What Is Form W 4 Tax Forms Signs Youre In Love Job Application Form

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

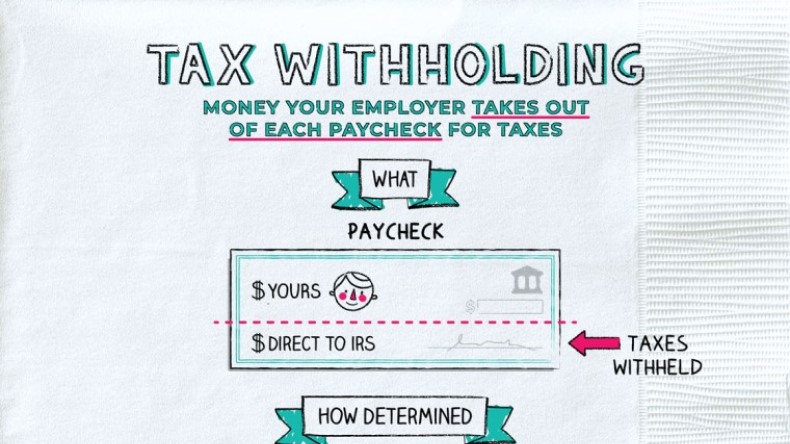

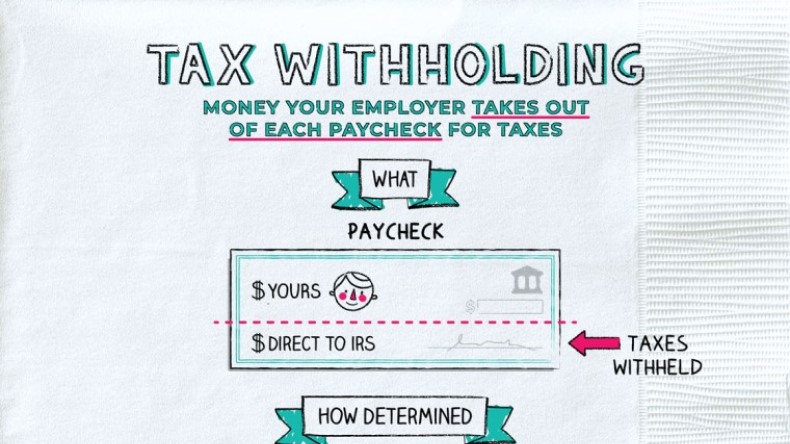

What Is Tax Withholding All Your Questions Answered By Napkin Finance

What Is Tax Withholding All Your Questions Answered By Napkin Finance

How Does An Employer Withhold Tax From An Employee Taxry

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Form W 4 Employee S Withholding Certificate 2016

Best Ways To Get The Most Money When You Fill Out Your W 4 Form W4 Tax Form Tax Forms Tax

Understanding Your W 4 Mission Money

What Are Payroll Taxes Payroll Taxes Bookkeeping Business Payroll

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Irs Issues New Regulations On Income Tax Withholding

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Filing Taxes Fillable Forms

9 Common Us Tax Forms And Their Purpose Infographic Tax Forms Us Tax Income Tax Preparation